Reading across disciplines is one of the best ways to improve our investment acumen. Here is a summary of some of the best articles I read this week. If you like this collection, consider forwarding it to someone who you think will appreciate it.

Noise is not just bias

Bias refers to judgments that depart from rationality in consistent, predictable ways. If you ask people to estimate the likelihood of dying in a plane crash, you can predict their answers will generally be biased upward because airline accidents are so vividly covered in the media and readily come to mind (the availability bias). In contrast, noise means that judgments are unpredictable, or scattered. If you ask a group of people to guess the weight of a bull, their answers will not be biased. They will be noisy, meaning they all depart from the true weight of the bull in unforeseeable ways.

Bias is characterized by systematic deviation in a predictable manner. Noise refers to random scatter. Interestingly, you don’t need to know the true answer to a question in order to infer the presence of noise in people’s judgments. For instance, if you ask 10 different physicians to diagnose a patient and they each return a different answer, then you can conclude that their answers are noisy, even if the true diagnosis remains unknown.

https://quillette.com/2022/04/

Concrete steps to lead a more contented life

- Give yourself the permission to treat yourself just like you would treat your friends or family members when they screw up. Allow yourself to be imperfect.

- See the difference between making a bad decision and being a bad person. Making a bad decision does not automatically make you a bad person.

- Accept that you are human and will necessarily make mistakes. This sense of vulnerability will also make you feel more connected to other people, as you realise that we all struggle.

- Recognise your flaws and setbacks as learning experiences and opportunities to grow. Embrace these challenges, persist in finding meaning in them and, most importantly, don’t give up on yourself.

- Practise gratitude. By noticing, affirming and appreciating the good things in your life, you will reduce the focus on what you don’t have. Gratitude can create a buffer against feelings of inadequacy and the tendency to ruminate.

- Stay in the present. Being mindful of where you are and what you’re doing can help you tamp down negative thoughts. However, it doesn’t mean that you should ignore the past. As the Danish philosopher Søren Kierkegaard said, “Life can only be understood backwards; but it must be lived forwards.”

- Focus on helping others. Generosity has great restorative function. However, you must consciously choose the recipients of your generosity, in light of your resources (from mental, physical, emotional to financial).

https://knowledge.insead.edu/

The more you have, the more you want

Inhabitants of prestigious institutions are even more interested than others in prestige and wealth. For many of them, that drive is how they reached their lofty positions in the first place. Fueling this interest, they’re surrounded by people just like them—their peers and competitors are also intelligent status-seekers. They persistently look for new ways to move upward and avoid moving downward.

The French sociologist Émile Durkheim understood this when he wrote, “The more one has, the more one wants, since satisfactions received only stimulate instead of filling needs.” And indeed, a recent piece of research supports this: it is the upper class who are the most preoccupied with gaining wealth and status. In their paper, the researchers conclude, “relative to lower-class individuals, upper-class individuals have a greater desire for wealth and status…it is those who have more to start with (i.e., upper-class individuals) who also strive to acquire more wealth and status.” Plainly, high-status people desire status more than anyone else.

https://quillette.com/2019/11/

Reading voraciously is a competitive advantage

During his five-year study of more than 200 self-made millionaires, Thomas Corley found that they don’t watch TV. Instead, an impressive 86 percent claimed they read — but not just for fun. What’s more, 63 percent indicated they listened to audiobooks during their morning commute.

Productivity expert Choncé Maddox writes, “It’s no secret that successful people read. The average millionaire is said to read two or more books per month.” As such, she suggests everyone “read blogs, news sites, fiction and non-fiction during downtime so you can soak in more knowledge.” If you’re frequently on the go, listen to audiobooks or podcasts.

Maybe you’re thinking: Who has the time to sit down and actually read? Between work and family, it’s almost impossible to find free time. As an entrepreneur and a father, I can relate — but only to an extent. After all, if Barack Obama could fit in time to read while in the White House, what excuse do you have? He even credits books to surviving his presidency.

President Obama is far from the only leader to credit his success to reading. Bill Gates, Warren Buffett, Oprah Winfrey, Elon Musk, Mark Cuban and Jack Ma are all voracious readers. As Gates told The New York Times, reading "is one of the chief ways that I learn, and has been since I was a kid."

https://www.entrepreneur.com/

Humans continue to evolve

Evolution is a gradual change to the DNA of a species over many generations. It can occur by natural selection, when certain traits created by genetic mutations help an organism survive or reproduce. Such mutations are thus more likely to be passed on to the next generation, so they increase in frequency in a population. Gradually, these mutations and their associated traits become more common among the whole group.

By looking at global studies of our DNA, we can see evidence that natural selection has recently made changes and continues to do so.

Survivors of infectious disease outbreaks drive natural selection by giving their genetic resistance to offspring. Our DNA shows evidence for recent selection for resistance of killer diseases like Lassa fever and malaria. Selection in response to malaria is still ongoing in regions where the disease remains common.

Humans are also adapting to their environment. Mutations allowing humans to live at high altitudes have become more common in populations in Tibet, Ethiopia, and the Andes. The spread of genetic mutations in Tibet is possibly the fastest evolutionary change in humans, occurring over the last 3,000 years. This rapid surge in frequency of a mutated gene that increases blood oxygen content gives locals a survival advantage in higher altitudes, resulting in more surviving children.

https://phys.org/news/2018-11-

~~~~~~~

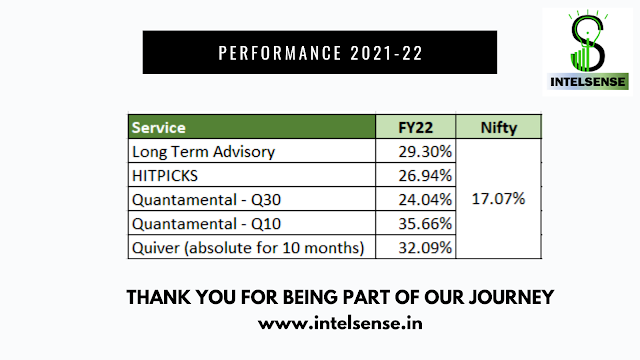

#Q30 is up ~7% so far in April. When the markets are trending, the moves can be sharp and big. (Q30 had a best-ever month of 18%+ in a single month on Feb 21.) A momentum strategy keeps you firmly where the action in the market is!

Check it out at: https://intelsense.smallcase.com