One of my main interests over the last five years has been in quantitative investing. The main trigger for it came to be because I could feel that a lot of investment outcomes are dependent on the whimsical nature of human psychology, so a better way to address this problem is to be able to codify some rules for investing. This approach has helped me immensely in my discretionary long-term investing as well.So, starting this month we are going to publish a quant newsletter. We will try to make it monthly (at least that is what we have thought for now). It will be only and only focused on quantitative investing concepts, stuff that we are reading and the state of the markets.

State of the Markets

Note: Why do we need to understand the state of the markets?

The state of the markets is like the “pitch” in a test match. The captain needs to read the pitch and then decide on the playing eleven. For example, if it is a turning wicket, you may wish to play an additional spinner. Similarly, based on the state of the market, you might wish to change your allocations or stock selection.

One of the ways in which market health can be measured objectively is by monitoring the market breadth. It is purely data-based, unbiased and objective. Like any other indicator, it needs to be evaluated in sync with many other factors together and never in isolation. However, it is a good metric to keep track of. As of now market breadth is strong.

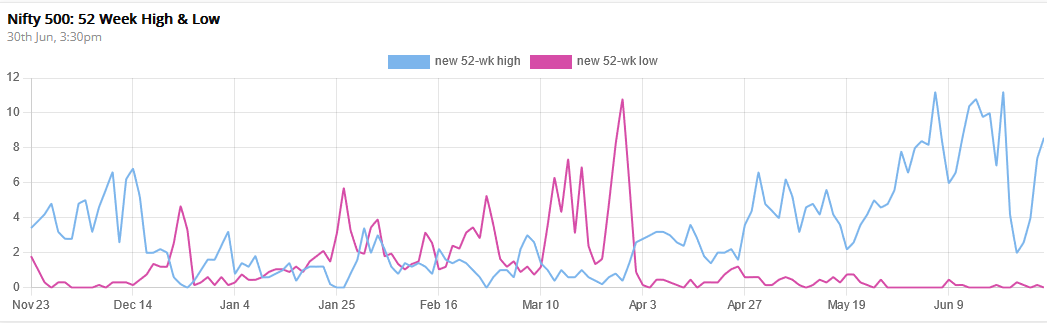

No of stocks hitting new 52 weeks highs is much higher than no of stocks hitting new 52-week lows (Universe Nifty 500).

Therefore the net new 52 highs and lows are strongly positive. (Universe Nifty 500).

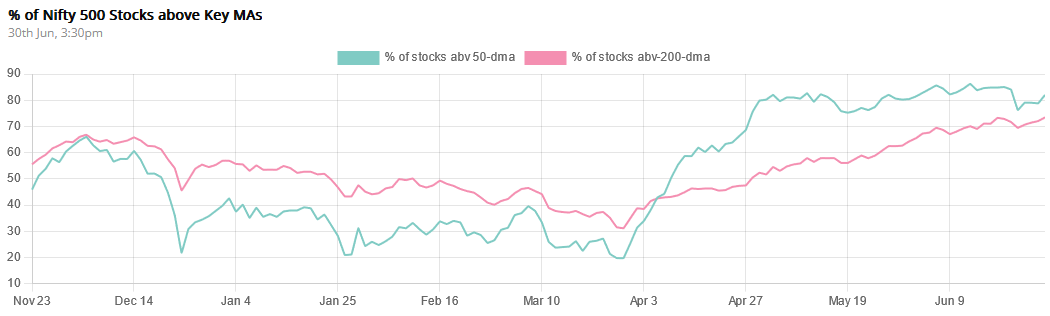

% of Nifty 500 stocks above key long-term moving averages is also signifying strength.

What we are reading: Lessons from Larry Hite

Larry Hite is regarded as one of the forefathers of systems trading. He grew up as a dyslexic, partially blind kid, facing failure and struggle at every corner. Despite such background, he went on to found and manage, Mint Investment Management Company which at its time became one of the most profitable and most significant quantitative hedge funds in the world. He authored a book “The Rule: How I beat the odds in the Markets and in Life-and How you can too”. It is a fascinating account of someone embracing his fears, frustrations, self-doubt and how this led him to accept markets as they are. In fact, his familiarity with failure helped him manage risks better and become successful in markets. There are some key lessons we can imbibe from his life and his market successes.

Create a system that you can put on autopilot:

At one time, due to an error of judgement made by his investing partner, Larry incurred serious losses and went into debt. He says “I looked at my debt and decided to go back and do what I really liked. I wanted to create an improved trading system that would remove human discretion entirely”. In due course, he precisely did that, and he goes on to say “We all signed a written agreement that none of us could countermand the system. It was liberating to let go. I was driven not so much by greed as by laziness. I wanted money to work for me, not the reverse. My goal was to create a system I could put on autopilot so I didn’t have to anguish over the ups and downs of the market. This way I could sleep at night, and even better, make money while I was sleeping.”

Markets are not efficient and trend following will never really die

Larry says, “Trend following will never really die since there are very few people who are not afraid of losing.” Let that sink in. Much like Warren Buffett, Larry doesn’t believe in efficient markets and says “Efficient markets don’t exist and never will as long as humans are playing the game with greed and fear in a tug of war. What makes this business so fabulous is that, while you may not know what will happen tomorrow, you can have a very good idea what will happen over the long run. I don’t make money because I know anything. I only make money because I do what the market tells me to do.”

You have to be comfortable with small losses:

Quantitative Investing is a business. Losses are the cost of doing business. Larry says “All major fortunes are built on a lot of small losses, which pave the way to big wins and success. I failed so often and so badly that I learned to get comfortable with it as a variable. Because I’d been a poor athlete and bad student, it never surprised me that I would lose. I would quickly accept it, fold my cards, and move on to come back to play another day. I recommend you practice losing money. In the long run, that will help you win big.” If you are not comfortable with accepting small losses frequently, you should not invest on your own, particularly in quantitative, trend-following strategies.

You have to manage risk all the time:

Larry’s system was based on controlling his risk to the downside so that he never loses all of his capital. He says “You can’t completely control outcomes. But you can control two things for sure. The odds of the bet you take, and the risk you take. If you keep placing good bets, over time the law of averages will work for you. If you keep placing bad bets, over time the law of averages will work against you.”

His failure helped him win big. How? “I always expected to fail big. Solution? I engineered my actions so that a failure could not kill me. I won because I always expected to lose.” That may sound paradoxical but is the single most key ingredient to success in investing using any kind of method.

Backtesting is important:

“Now, obviously, just because you get something right in the past doesn’t mean you will get it right in the future—historical testing has its flaws. Just the same, these simulations were highly valuable because using real market conditions—even in the past—gave us far better information than hypothetical scenarios of us sitting around the office guessing.”

Drawdowns are a feature and not a bug:

Based on Larry’s experience in running trend-following strategies successfully, he makes it clear, “Be prepared to lose roughly the size of your annual return. For example, a strategy with a 10 per cent return over time should be expected to suffer at least double the annual return in a 20 per cent drawdown—so a strategy with a 30 per cent return over time should be expected to suffer a 60 per cent drawdown.”

Larry Hite Quotes worth reflecting upon:

- Follow the crowd and go where the money goes.

- If you’re offered a seat on a rocket ship, don’t ask what seat. Just get on.

- Why will trend following never really die? There are very few people who are not afraid of losing.

- When you start following slick reports filled with predictions, you’re just finding out who has good copywriters.

- Global financial markets are not best explained or traded by stories but rather by numbers (which are the only facts).

- Markets are the ever-shifting accumulation of cold economic interests competing for superiority within regulated legal systems.

We will be back next month with the state of the markets review and update on what new we are learning in the field of quantitative investing.

No comments:

Post a Comment