An Intelsense Knowledge Series - we regularly study interesting businesses. We keep profiling them. The idea is to keep learning and expanding our knowledge base.

Dr Hitesh Patel and I have been working together and collaborating in personal investing for a long time. I have always been a long-term-oriented investor who was more interested in compounding and growth stocks. During my many conversations with Hitesh Bhai (that’s what everyone calls him), I started appreciating the nuances of market dynamics which led me to technical analysis (and subsequently to quantitative analysis, but that’s a story for another day).

As I kept learning and applying these skills to my own investing, I realised that it is a potent tool for capturing opportunities in the small-to-medium timeframe (a few months to a few quarters).

Foundations of Hitpicks

In 2020, as part of my strategy of style diversification, we launched Hitpicks as part of Intelsense.in.

The core in any shorter duration “positional trading” has to be based on technical analysis. We brought in an overlay of fundamentals where we look only at fundamentally strong companies for technical chart patterns and breakouts. Transactions will be frequent. This is basically meant for those who have a short-to-medium-term horizon. This was completely different from the traditional buy-and-hold investing approach that we are all used to.

The experience so far has been reasonably good.

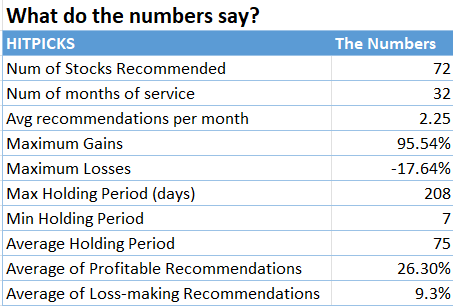

Let’s look at some numbers

It is very evident from this that we have been able to capture decent gains when we have been right and limit our losses when we have been wrong.

The holding period is roughly 2.5 months on average though we have gone up to five-seven months on occasion. When the holding period is low, it typically means that we have been stopped out of the position.

And although we don’t have a target number of recommendations in mind and we only recommend a stock when we feel it gives a good risk-reward, the average has been about 7 recommendations per quarter.

The Advantages of Technofunda approach

Since we have followed a technofunda approach we have been able to steer clear of stocks with poor fundamentals or very high valuations. For example, none of the Adani stocks ever came up in our universe of stocks due to the fundamental filter.

Another major advantage I have seen is when the market overall takes a downturn, because of the individual stop losses being in place, you are forced into cash. There is no need for a lot of market or index-level analysis because your stock holdings tell you what is happening in the market.

The Challenges of Technofunda approach

As we followed targets based on technical charts, we exited early in a lot of cases. For example, we recommended Balaji Amines at Rs 491 and exited with an 80% profit in a span of two months, a great achievement we thought. However, the stock went onto Rs 4800 levels and became nearly a 10-bagger!!

Similarly, we have had multiple cases where we got stopped out and the stock subsequently went up as per our initial analysis.

Summary

Hitpicks has been fairly effective in diversifying away from a long-term buy-and-hold approach. It also provides a steady stream of good stock ideas which are strong fundamentally and attractive technically. Most of the stocks could also very easily be bought and held for longer durations. In turbulent markets, have seen whipsaws, but that I feel is par for the course.

Click here to subscribe to Hitpicks.