INDIAN WIND ENERGY OVERVIEW

According to the CEA, wind and solar energy are the most prevalent renewable energy sources, aside from large hydroelectric power plants (more than 25 MW). At the end of January 2022, wind energy contributed 38% to India’s total renewable energy capacity.

Wind energy capacity increased at a CAGR of 8.4% from FY14 to FY22.

India’s wind energy sector is led by the country’s own Wind Turbine Generators (WTG) manufacturing industry, which has made steady progress over the years. A robust ecosystem, project operation capabilities, and a manufacturing base capable of producing approximately 10,000 MW per year have emerged from the rise of the wind sector. As a result, it achieved a cumulative capacity of around 40 GW in January 2022.

The pandemic, and most recently the second wave in India, had undoubtedly impacted the Indian wind energy industry’s performance. Production of wind towers, among other fabrication work, was de-prioritised as oxygen supply for industrial processes was diverted to medical requirements during this phase. However, since the second half of 2021, manufacturing and installation activities have slowly picked up. As a result, over 1.4 GW of wind energy assets are estimated to have been installed (by GWEC), surpassing the 1.1 GW installations from FY21.

OFFSHORE WIND DEVELOPMENT IN INDIA:

India aims to achieve an installation of 450 gigawatts (GW) of renewable energy capacity by 2030 to decarbonise its energy sector while pursuing its commitment to becoming a net-zero country by 2070. Currently, India’s installed renewable energy capacity is 111.39 GW. According to the latest data, India (2021-22), added 15.5 GW of renewable energy capacity with $14.5 billion (Rs11,338.8 crore) investment pouring into the sector.

30 GW of the committed capacity is to be achieved exclusively through offshore wind capacity, adding mileage to this sector.

India’s 7,600 KM long coastline, which is one of the longest in the world, provides vast potential for offshore wind power asset development in the nation.

Beginning from FY23, offshore wind bids to the tune of 4 GW per year (for a period of three years) are expected to be rolled out off the coast of Tamil Nadu and Gujarat for the sale of power through open access, captive, bi-lateral third-party sale, or merchant sale route.

KP Energy - A major player in the wind energy industry

KP Energy Limited is a leading name in the wind energy industry, providing Balance of Plant (BoP) solutions to its clientele.

Its presence is across the entire wind farm development value chain, right from the conceptualisation stage to the commissioning of a project, and thereafter operation and maintenance of the project.

KP Energy also plays a critical role in coordinating a wide range of activities related to utility-scale wind farm development.

Providing the turnkey balance of plant solutions for the project, including wind site locations, obtaining necessary approvals and development permits, wind data management, etc.

The company is a part of KP group which has an established track record of more than two decades in the infrastructure industry. KP Group is engaged in businesses of utility-scale renewable energy projects, microgrid solar projects, construction projects, fabrication & galvanizing and telecom infrastructure (telecom tower & OFC network) through its group companies. Promoted by Faruk Patel and Ashish A Mithani, KPEL is currently managed by Faruk Patel who possesses more than two decades of experience in various industries and around a decade in the wind energy segment. He is ably supported by his son Affan Patel and a team of experienced professionals, forming a strong second line of management for the execution of projects.

PROJECTS UNDERTAKEN BY KP ENERGY LIMITED:

KP Energy to develop wind projects worth ₹222 Cr for Aditya Birla Group:

KP Energy has bagged an order worth ₹222 crs to develop wind energy projects for Aditya Birla Group with the scheduled commissioning in March 2023.

KP Energy stated that it has aligned with Aditya Birla Group to develop the wind power project at Bhungar and Fulsar Site at Mahuva, Bhavnagar, Gujarat, under the Gujarat hybrid power policy 2018.

KP Energy will be responsible for providing the turnkey balance of plant solutions for the project, including wind site locations, obtaining necessary approvals and development permits, wind data management, windfarm development works, electrical line network and complete power evacuation capacity from pooling substation to GETCO (Gujarat Energy Transmission Corporation).

GADHSISA PROJECT - 300 MW:

In this project, the implementation of the contract provisions, deliverables and pending tasks have been completed and the company has also received the work completion certificate. As per the agreed-upon timelines and conditions, precedents are in progress, and they expect to complete the project in Q1FY23. Moreover, this will help the Company to optimise its liabilities and focus on its growth avenues.

MAHUVA - I PROJECT

KP Energy has commissioned this 15.3 MW project for a captive power consumer at the Mahuva Site well within the timelines. Despite a slight delay in WTG delivery, they were still able to commission this project in the shortest record time of four months due to their preparedness in the Balance of Plant activities which included area development, making access roads, laying foundations and a 33kv internal line network.

KP Energy Developed 251 MW Wind Project in Gujarat for CLP India:

KP Energy Limited had tied up with CLP India, one of the largest foreign investors in the Indian power sector to develop a 250.8 MV wind project in Dwarka in Gujarat.

KP Energy will be responsible for providing the turnkey balance of plant solutions for the project, including wind site locations, obtaining necessary approvals and development permits, wind data management and windfarm development works.

The company will also take responsibility to complete the power evacuation infrastructure comprising 220 kV dedicated lines and a pooling substation at Sidhpur in Dwarka.

BUSINESS MODEL:

A well-balanced combination of three business segments; namely

1. Project Based Revenue Engineering, Procurement, Construction and Commissioning (EPCC):

Their competence in the sector is because of:

SITE IDENTIFICATION & ACQUISITION

Their key competence is identifying and acquiring good windy sites for utility-scale wind farms.

SITE PREPARATION

They construct access roads and fetch ROWs in tough and challenging situations.

CONSTRUCTION & ERECTION

WTG civil foundation, 33kv USS & internal network as well as logistics, installation & erection of WTG.

POWER EVACUATION

They undertake EPCC of 33/66 & 33/220 KV wind farm pooling substation and EHV lines.

PERMITS & APPROVALS

They obtain all requisite permits & approvals from government authorities for the project execution and its operational life.

2. Operations and Maintenance (O&M):

KPEL undertakes O&M services for the BOP portion of its projects so that its clients don’t have to engage in the same. Energized wind assets are maintained for smooth functioning over their lifecycle.

3. Independent Power Producers (IPP):

KP Energy has its own power generation assets of 8.4 MW (4*2.1 MW) capacity at its own wind farms which is a recurring, annuity revenue stream for the company. It provides stability of cash flows in periods with lower capacity additions.

Growth Strategy of the Company:

Being dependent on one revenue stream is certainly not good. Thus, in this regard, the company is contemplating expanding their supplementary business verticals, O&M and IPP (mentioned in the annual report of 2021-22).

To build on their annuity income, they are also in the midst of evaluating projects to expand their power generation assets. Currently, they operate 8.4 MW of wind generation assets, but in their second phase, they are also looking to add wind-solar hybrid capacity. The plan is to sell the energy generated from this project to the C&I (Commercial and Industrial) customer base through the third-party sale mechanism under Open Access.

They have executed a Business Transfer Agreement with their wholly-owned subsidiary, which will independently operate and maintain its conceived projects. This subsidiary will also tap into different geographies and assets under its OMS umbrella by leveraging its long-standing exposure and position in the market.

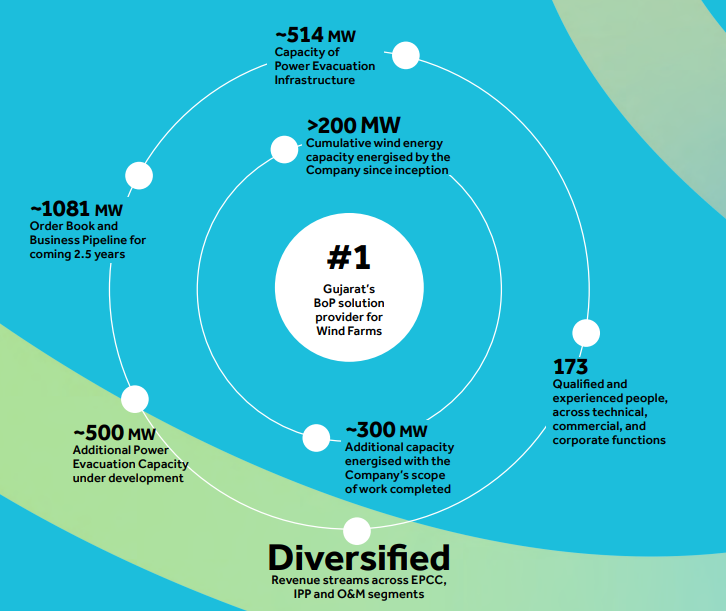

Accomplishments of the company:

Gujarat’s number 1 Balance of Plant (BoP) solution provider for Wind Farms

Commissioned a 15.3 MW Wind Power Project for Captive Customers in a record time of 4 months

Emerged as the winner of the India Wind Energy Forum 2021 Awards in the category of Business Excellence Award – “Company of the Year: Developer > 1000 MW”

Greater than 200 MW Cumulative wind energy capacity energised by the Company since inception

Around 300 MW of additional capacity energised with the company’s scope of work completed

Around 514 MW Capacity of Power Evacuation Infrastructure

Around 1081 MW order book and business pipeline for the coming 2.5 years

Around 500 MW of additional power evacuation capacity is under development

RISK & RISK MITIGATION:

REGULATORY RISK:

This industry is a segment of the renewable energy industry. The renewable energy industry is eminently a regulated space, wherein any changes in Government and regulatory policies may impact the company’s performance. Any adverse changes in the wind energy policy or amendments in policies related to power evacuation facilities can significantly impact the operations of the industry and the Company.

BUSINESS RISK:

The company’s revenue streams are derived from capital expenditure in the wind energy space by either Independent Power Producer (IPP) or Captive Power Producers (CPP).

Therefore, depending upon the capital expenditure scenario and cycle, a reduction caused by either of them could adversely affect the financial performance of the company.

The company’s revenues come predominantly from one geographical location of Gujarat which could be a negative in the long run.

PROJECT DEVELOPMENT RISK

The project development process has several risks such as - building permits, land acquisitions and logistics which can lead to delays, cancellations and write-offs of projects. This may have a severe impact on the profitability of the business. In addition, project delays also lead to cost overruns which may impact profitability.

GROUP COMPANIES

1. KPI GREEN ENERGY LIMITED

Solar Energy Industry

KPI Global Infrastructure, the solar energy arm of the KP Group, is a multi-dimensional solar energy company with interests in power generation both as an Independent Power Producer (IPP) and as a service provider to Captive Power Producers (CPP). Operating under its brand name ‘Solarism’, it engages in providing turnkey solutions to its clients.

2. KP BUILDCON PRIVATE LIMITED

Galvanisation and Fabrication

KP Group’s flagship company, KP Buildcon Private Limited, is one of India’s largest Telecom Infrastructure providers since 2009. Its clientele includes the World’s Largest Telecom Towers Company.

3. KP HUMAN DEVELOPMENT FOUNDATION

Non-Profit Organisation

The KP Human Development Foundation is one of the entities of KP Group, established as a Non-Profit organisation in 2015. Over the years, the NPO has embarked on its journey towards facilitating quality education, helping the underprivileged, and improving the quality of healthcare in its communities.

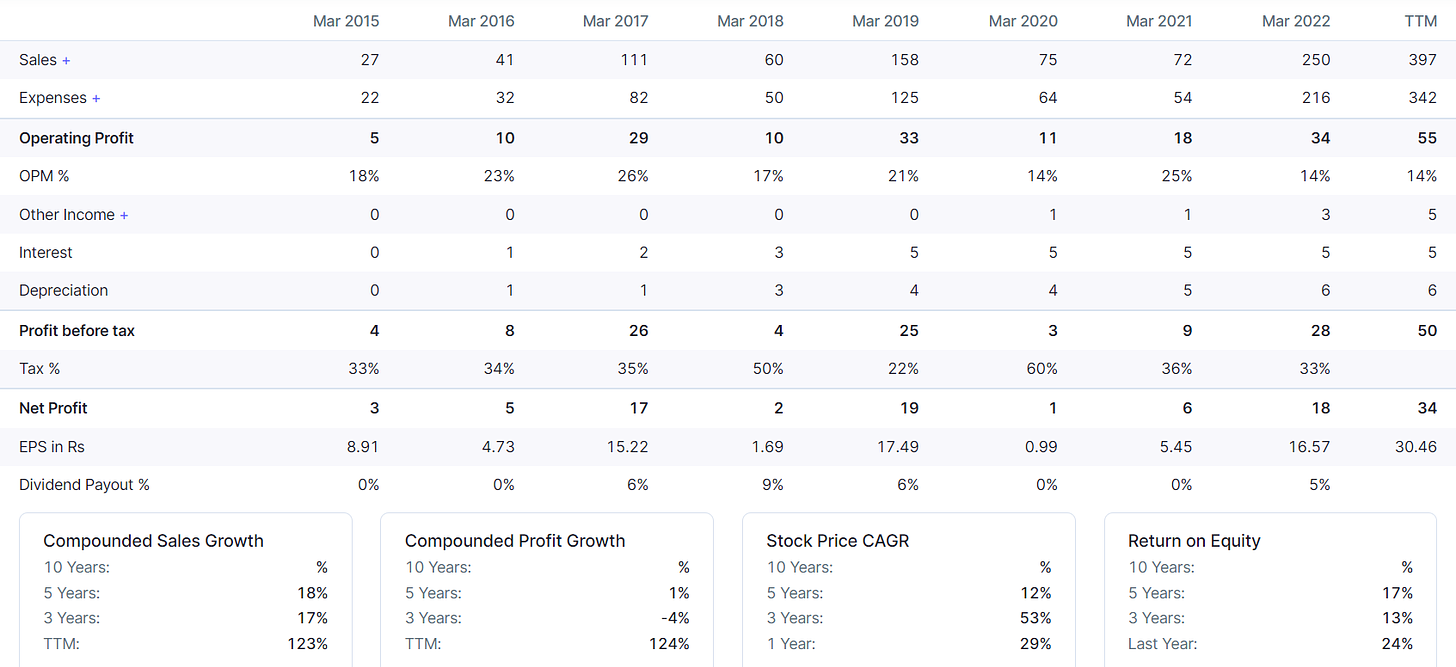

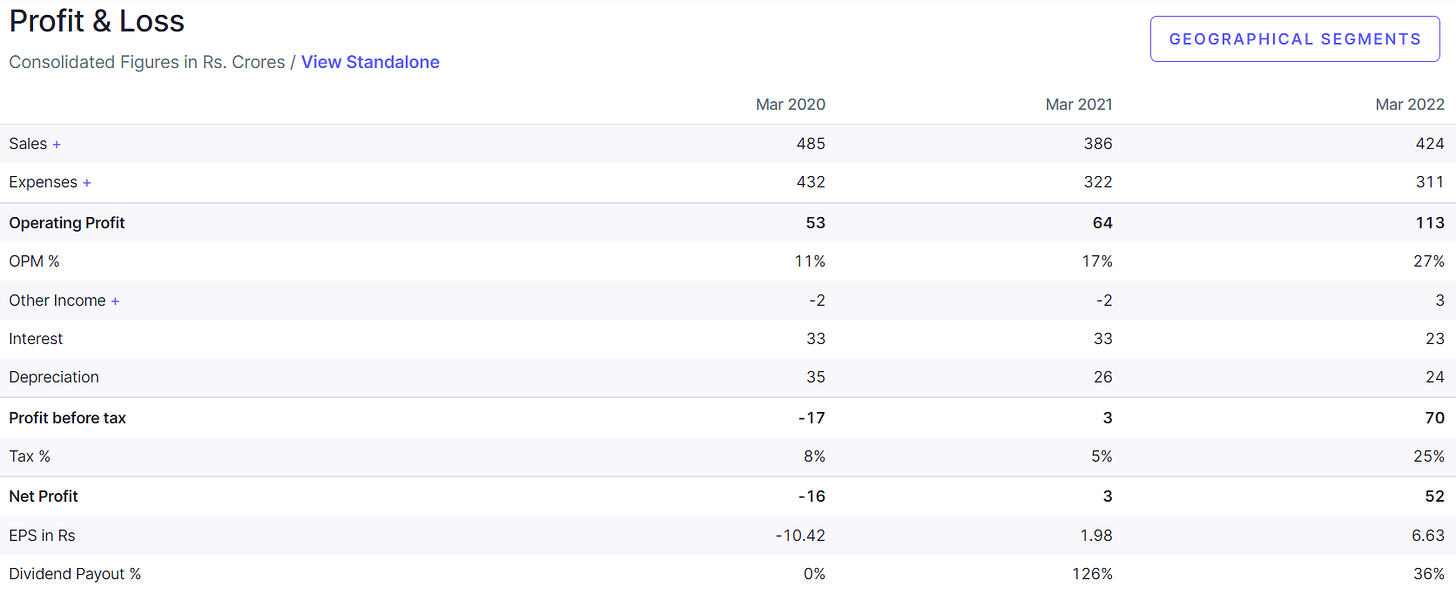

Financials

The company has seen the ups and downs of the wind energy industry. Till a few years back the main reason wind energy plants were being set up was to get tax and accelerated depreciation benefits.

Even in a severe pandemic year like 2020, the company managed to remain profitable.

With an increased focus on green energy and renewables, KP Energy has shown robust growth in recent quarters.

It has a ROCE of 30% and a debt-to-equity (D/E) of 0.21.

DISCLAIMER:

This is for EDUCATIONAL purposes only.

At Intelsense we regularly study interesting businesses. We keep profiling them. The idea is to keep learning and expanding our knowledge base.

It does NOT construe a BUY or SELL recommendation on the stock.