• Aarti Industries (AIL) has 3 divisions –

o Specialty chemicals - Polymer & additives, Agrochemicals & intermediates, Dyes, Pigments, Paints & Printing Inks, Pharma Intermediates, Fuel Additives, Rubber chemicals, Resins, Fertilizer & Nutrients

o Pharmaceuticals – APIs, Intermediates for Innovators & Generic Companies

o Home & Personal Care - Non-ionic Surfactants, Concentrates for shampoo, hand wash & dishwash

• One of the leading supplier to global manufacturers of Dyes, Pigments, Agrochemicals, Pharmaceuticals & rubber chemicals.

• Manufacturing units (16):

o Specialty chemicals - 10

o APIs - 4

o home & personal care chemicals – 2

Specialty Chemicals

• Largest nitro-chlorobenzene producer of India with a capacity of 60,000 TPA

• Amongst the largest producers of Benzene based basic and intermediate chemicals in India

• Lowest cost producer of Benzene in the world

• Exports account for 51% of specialty chemicals division with 90% of exports USD denominated

• Offers 100+ products to MNCs globally; has "strategic supplier" status with many

• Globally ranks at 1st – 4th position for 75% of its portfolio

• Works on a cost+ model. Increase in cost of benzene will increase working capital requirement funded by short term debt. Decrease may lead to inventory losses and revenue reduction

• Benzene accounts for ~60% of the company’s revenues, while aniline and sulphuric acid compounds contribute ~12% to revenues.

• With start of the Dahej facility of 30,000 TPA capacity in Q1FY18, AIL will also enter toluene chemistry.

• Exports contribute ~50% to revenue with incremental capex planned to enhance standing in the export market.

• Co supplies products to more than 500 domestic customers and over 150 international customers from 50 countries with a major presence in USA, Europe, China, Japan and India. The customer list comprises marquee brands like BASF, Bayer, Clariant, Dow, DuPont, Flint Ink, Hunstman, Makhteshim Agan, Micro Inks, Solvay, Sudarshan, Sun Chemicals, Syngenta, Teijin, Ticona, Toray, UPL Limited

• Largest nitro-chlorobenzene producer of India with a capacity of 60,000 TPA

• Amongst the largest producers of Benzene based basic and intermediate chemicals in India

• Lowest cost producer of Benzene in the world

• Exports account for 51% of specialty chemicals division with 90% of exports USD denominated

• Offers 100+ products to MNCs globally; has "strategic supplier" status with many

• Globally ranks at 1st – 4th position for 75% of its portfolio

• Works on a cost+ model. Increase in cost of benzene will increase working capital requirement funded by short term debt. Decrease may lead to inventory losses and revenue reduction

• Benzene accounts for ~60% of the company’s revenues, while aniline and sulphuric acid compounds contribute ~12% to revenues.

• With start of the Dahej facility of 30,000 TPA capacity in Q1FY18, AIL will also enter toluene chemistry.

• Exports contribute ~50% to revenue with incremental capex planned to enhance standing in the export market.

• Co supplies products to more than 500 domestic customers and over 150 international customers from 50 countries with a major presence in USA, Europe, China, Japan and India. The customer list comprises marquee brands like BASF, Bayer, Clariant, Dow, DuPont, Flint Ink, Hunstman, Makhteshim Agan, Micro Inks, Solvay, Sudarshan, Sun Chemicals, Syngenta, Teijin, Ticona, Toray, UPL Limited

Pharma

• Pharma business has broken even in FY12 and can aid in growth

• Company has two USFDA facilities one for API and another for Intermediates.

• Comprises of about 15% of total revenues

• 48 commercial APIs with 33 EDMF, 28 USDMF and 16 CEP. 12 new APIs under development

• Pharma business has broken even in FY12 and can aid in growth

• Company has two USFDA facilities one for API and another for Intermediates.

• Comprises of about 15% of total revenues

• 48 commercial APIs with 33 EDMF, 28 USDMF and 16 CEP. 12 new APIs under development

Home & Personal Care Chemicals

• Low margin business

• Expected to grow on the back of larger consumption of hygiene and personal care products. Increasing consumption is driving the demand for range of cosmetic chemicals, health care products and hygiene products using performance chemicals, polymers and oleo chemicals.

• Comprises of about 5% of total revenues

• Low margin business

• Expected to grow on the back of larger consumption of hygiene and personal care products. Increasing consumption is driving the demand for range of cosmetic chemicals, health care products and hygiene products using performance chemicals, polymers and oleo chemicals.

• Comprises of about 5% of total revenues

Industry Overview

• Indian specialty chemicals industry is around $25 bn (FY13-14 FICCI report)

• India contributes about 3% of global specialty chemicals industry, which leaves a very large opportunity size.

• Global chemical companies are de-risking the supply chain for their raw-material by diversifying from China to India

• The most impactful regulation from an Indian perspective has been the European Union’s REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which went into effect in June 2007. This legislation addresses the production and use of chemicals and their potential impact on human health and environment. The substantial impact of REACH will come into play following the implementation of Phase 3 from June 2018 that will regulate any chemical supplied to EU at quantities of 1 tonne per annum or more. Aarti has been REACH-complaint since 2011.

• Indian specialty chemicals industry is around $25 bn (FY13-14 FICCI report)

• India contributes about 3% of global specialty chemicals industry, which leaves a very large opportunity size.

• Global chemical companies are de-risking the supply chain for their raw-material by diversifying from China to India

• The most impactful regulation from an Indian perspective has been the European Union’s REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), which went into effect in June 2007. This legislation addresses the production and use of chemicals and their potential impact on human health and environment. The substantial impact of REACH will come into play following the implementation of Phase 3 from June 2018 that will regulate any chemical supplied to EU at quantities of 1 tonne per annum or more. Aarti has been REACH-complaint since 2011.

Competitive Landscape

• Chlorination (ranked among the top three globally)

• Nitration (ranked among top four globally)

• Ammonolysis (ranked among the top two globally) Hydrogenation (ranked among the

top two globally), and

• Halex Chemistry (only player in India).

• Chlorination (ranked among the top three globally)

• Nitration (ranked among top four globally)

• Ammonolysis (ranked among the top two globally) Hydrogenation (ranked among the

top two globally), and

• Halex Chemistry (only player in India).

Risks & Concerns

• Co operates in an environmentally sensitive sector and is open to regulatory risk. Government can put in place stringent environmental guidelines which may make their products uncompetitive internationally.

• Fire and accident hazards during operations causing major disruptions cannot be ruled out.

• Issues with US FDA / cGMP on pharma APIs

• Co has exposure to foreign currency fluctuations

• Debt is high

• Though co works on a cost plus basis model in its speciality chemical segment, any significant increase in benzene prices will increase the working capital requirement for the business funded by short term debt, leading to increase in interest outgo and decline in profitability.

• Fire and accident hazards during operations causing major disruptions cannot be ruled out.

• Issues with US FDA / cGMP on pharma APIs

• Co has exposure to foreign currency fluctuations

• Debt is high

• Though co works on a cost plus basis model in its speciality chemical segment, any significant increase in benzene prices will increase the working capital requirement for the business funded by short term debt, leading to increase in interest outgo and decline in profitability.

Management

• Management compensation aggregates to 10.25cr and is especially high amongst the Gogri family members.

• Management has maintained a dividend payout of over 25% for the last 10 years

• Management is paying out full tax

• Management compensation aggregates to 10.25cr and is especially high amongst the Gogri family members.

• Management has maintained a dividend payout of over 25% for the last 10 years

• Management is paying out full tax

Financials

• Net debt / Equity is 1.9 at the consolidated level, which is on the higher side. Interest coverage ratio is 4.89 which is healthy.

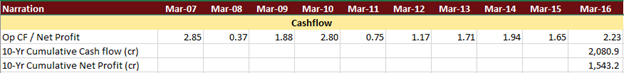

• Co has maintained strong operating cash flow / net profit ratio, which means they have been able to generate cash successfully over a long period of time.

• Net debt / Equity is 1.9 at the consolidated level, which is on the higher side. Interest coverage ratio is 4.89 which is healthy.

• Co has maintained strong operating cash flow / net profit ratio, which means they have been able to generate cash successfully over a long period of time.

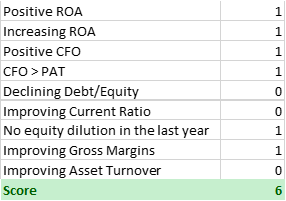

Piotroski's F-score Analysis

Co fairs well in the Piotroski’s F-score with a score of 6 (out of 9). The 3 points where it did not get a score were very near misses.

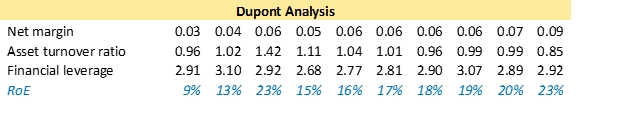

Dupont Analysis

• Majority of the ROE is being derived from the financial leverage. The co is slowly improving its margin profile and can maintain its ROE at the current level, even if they reduce debt. At the same level of leverage, ROE can be improved by better margins.

• With a large part of the capex already done, specially for the toluene plant, asset turnover is likely to improve, thus improving ROE further.

• The co is consistently improving its ROE over the last 5 years

Key Assumptions & Key Monitorables

• Growth led by capacity addition will continue

• Debt-Equity levels will not rise further

• Margins will be on an upward trend based on better product mix

• No issues with US FDA or any other regulatory compliance

• Toluene and ethylation plants get onstream with good capacity utilization

• Growth led by capacity addition will continue

• Debt-Equity levels will not rise further

• Margins will be on an upward trend based on better product mix

• No issues with US FDA or any other regulatory compliance

• Toluene and ethylation plants get onstream with good capacity utilization

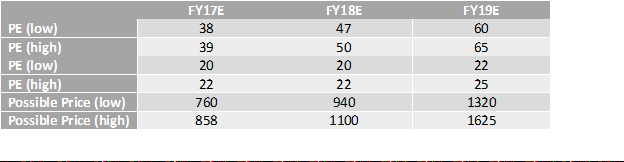

Valuation