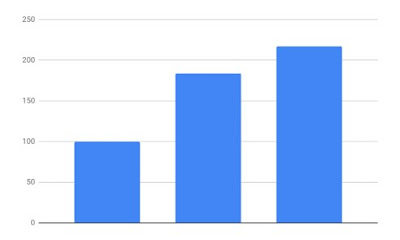

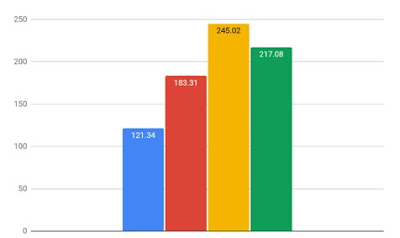

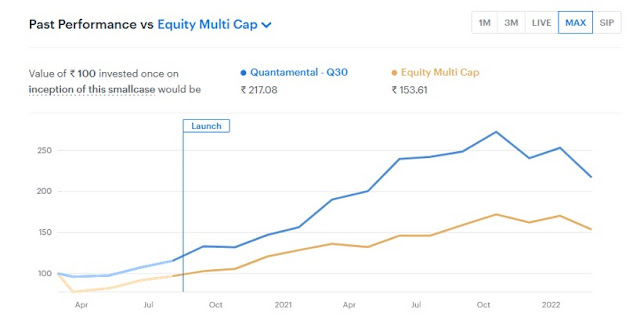

Would you invest in a strategy if you double your money in 2 years? (100 Rs invested roughly becomes 217 in 2 years)

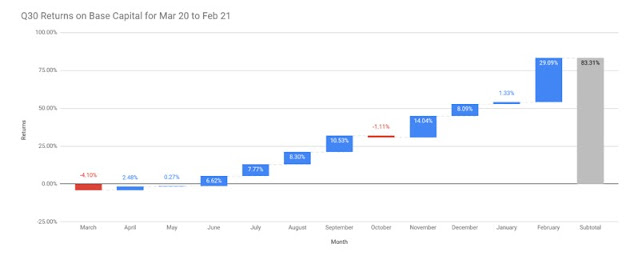

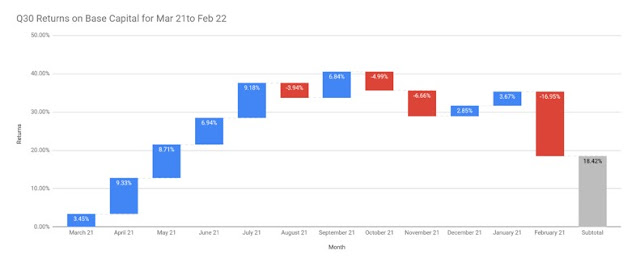

But this is not how the returns accumulate. Most of these returns came in the 1st year. ~83% in 1st year and 18% in 2nd year. Would you still invest?

Let’s break it down further. What if the 4 periods each of roughly 6 months had the following returns? 21.34%, 51.07%, 33.66%, (-11.40%)

Let’s take the worst-case scenario. What if you had invested at the top? You would have lost 25% of your capital by now. Would you still invest?

As you might have guessed this is not a hypothetical scenario. Q30 has completed 2 years. 100 at the start has become ~217 now (the way model portfolio returns are calculated in a standard manner, taken from smallcase daily NAVs publicly available here https://intelsense.smallcase.com/smallcase/INSMO_0003) It has beaten the market handsomely and CAGR is coming to ~47%.

47% CAGR in 2 years which had both covid fall and the last few months of market mayhem is nothing but spectacular. Except that most of us Q30 investors are not happy (including us). There is human psychology at play.

Which scenario would you be happier in?

Scenario 1: Start with 100. Make some

returns every month. End up with 217 now.

Scenario 2: Start with 100. Go to 272. Then

crash to 217 now.

Same results. Different paths. Different

feelings. Except that 2nd path is perfectly normal and it is what will

keep getting repeated. Again, and again. Even in our backtests shared at

launch, we had 1 out of 4 quarters negative. 1 out of 4 years negative.

Drawdowns exceeding 30%. In the real world, we have been trying to avoid deeper

drawdowns as none of us has the stomach to digest it even if it comes with

very high returns. We will have to give up some returns to remain within a

drawdown level. There is no point showing 50% CAGR on paper, if many of us get

scared somewhere and quietly exit the portfolio, saying not my cup of tea.

What can help you stick with it? First of all, having expectations in line with how it is going to work in real world

- Returns will not be linear. Some quarters and years will be great. Some others will be horrible. If you don’t stick through the horrible, you will not be there to see the great.

- If you join at the wrong time and don’t stick long enough, you may actually lose money. Wrong time or right time is known only in hindsight no matter what is the market level, global news, or under/overvaluation. If you try to get in or out, you may end up doing worse than what the system has achieved.

- The system already has an element of market timing built-in. It won’t get stocks to invest in if the market is bad. Today we are at the end of the month. And there is not a single stock that meets our eligibility filter to invest. In periods of prolonged bearishness, this will force us to remain in cash to some degree or fully. Trying to apply discretion on top of it, might be intellectually stimulating but it is unlikely to result in better risk-adjusted returns.

- Our goal is to compound at a higher rate than the market with low effort. If market returns are say 15% p.a. over a decade long rolling period, we would be happy to get 20%+ p.a.

- Wait, are we doing all this to get 5% extra than the market? Isn’t that horrible? Not really if you do the math. 10 Lakhs rupees invested for 20 years at 15% p.a. is roughly 1.7 crores. At 20% p.a., it becomes nearly 4 crores. The right question to ask is not what is the highest return strategy that is available anywhere but what is a high a return strategy that I can stick with for long periods and let my investment compound without getting scared out of it either due to volatility or my temperament not matching with something to do with the strategy be it the kind of stocks, buying/selling frequency etc. And this is something only you can decide.

- Last 2 years Nifty has approximately returned 49%. Q30 has returned 117%, translating it into 47% CAGR for 1st two years against Nifty CAGR of ~22%. Everyone knows Nifty won’t generate 22% CAGR over longer time periods and neither will we generate 47% CAGR for longer time periods. The point is not to fuss about whether long term CAGR will be 20% or 40% but whether i) there is a high probability that it will beat the market, ii) it will beat it by a margin that makes the effort worthwhile, iii) the effort is low enough for me to live my life and not bother about my portfolio every day and iv) My temperament is aligned to it so that I can follow it for long periods and let my capital compound.

What can help you stick with it? Second, having some degree of asset allocation in place so that you don’t have the itch to bail out at the wrong time or feel the urge to check it every day thinking what to do. Repeating what we have written in several Quantletters

- Decide on the asset allocation first. Allocate a certain % of your equity portfolio to this quant portfolio. Not recommended to invest more than 25% of your equity portfolio in the quant strategy. Start with a smaller allocation and scale up as you build confidence

- You may be tempted to pick and choose stocks or vary the allocation. Please do so in your discretionary portfolio taking the quant list as a source of ideas. However, for quant portfolio, please stick to the recommended model so that you stay closer to model portfolio returns

- There is no buy range or targets. Any day you start, is a good time to buy provided you are buying the whole basket and not cherry-picking.

- We are not full-time investors watching the screen all the time and trying to time entries and exits to perfection. Many of the times, we will buy/sell stocks at the wrong time at the wrong price because we are following a discipline and we want to be active only once a week at most for a few mins. This convenience comes at a price, but it also ensures that we can follow this for years.

Volatility has a cost – would you not factor it, unless of course you ride/ time it?

ReplyDelete