JK Lakshmi cement is a strong player in North

India with a dominant position in Rajasthan. Other states where the

company has a presence include Haryana, Delhi, Punjab and

Uttarakhand in north. In the west also, the company has a

healthy presence in Gujarat and has made inroads in the Mumbai markets

as well. Sales wise, Gujarat contributes highest at ~35% of sales

while Rajasthan contributes 27%. The contribution from the rest

of the north region is at ~31%. Maharashtra contributes ~7% to topline.

NOTES FROM AR2015-16

Integrated cement plant at Durg started commercial production in FY2016 and has reached almost full capacity utilization in less than a year.1.35 MTPA grinding unit at Surat has been commissioned at the end of FY16 and is in the stabilization phase Total capacity across locations is 13 MTPAThe company plans to deleverage its balance sheet before progressing on brown field expansionsTied up with Snapdeal and is the first company in India to foray into online sellingCo had a capacity utilization of 82% as against an industry average of 66%The co continues to be one of the lowest cost producersThe Durg Plant has performed satisfactorily in the very first full year of its operations and achieved 104% capacity utilization in the last quarter of FY 2015-16. Company has become a third largest player in Chhattisgarh market in a short span of time.

NOTES FROM Q1FY17 Concall

Durg plant:

In the quarter, sales from the East plant was 0.5mt against 0.19mt in Q1FY16. EBITDA has turned positive for the plant in the quarter primarily led by cost reduction as realization remains weak. The company is buying power for the plant at Rs6.8/unit from the grid which is very expensive (CPP generat ion cost is Rs4/unit). In order to save energy costs, it is in process of commissioning WHRS of 7MW (to be operational by Sep - 17). However, it will be able to cater to only 30% of the power requirement of the unit. Hence, the company is also trying to source power from private source which will be relatively lower than the grid cost (but not as low as the CPP cost). This is expected result in cost savings of Rs150/tn. Also, construction of railway siding is under progress and is expected to be com missioned by the FY18 - end which may further lead to savings Rs300 - 350/tn. Through these initiatives, saving of at least Rs300 - 400/tn is expected in the opex of East plant.

Product and sales mix of East plant :

East plant is currently producing 75% PPC and 25% OPC+PSC. This plant is currently selling 60% in Chhattisgarh , 20 - 25% in Orissa and rest in other markets. Larger exposure to Chhattisgarh market has led to lower realization for this unit . Thus company’s focus is more on cost saving so that the profitability can be improved.

Capex update:

The coompany has planned capex for a) Rs150cr for the capacity expansion at Durg plant from 1.8mt to 2.7mt (expected to get commissioned by Jun - 17), b) Rs90cr for WHRS unit of 7MW (to be operational by Sep - 17, c) Rs 100cr for the grinding unit at Orissa (0.6mt), to be operational by Sep - 17, d) Rs150cr for railway siding at the Durg plant (expected to get commissioned by FY18 - end ) and e) Rs20-22 cr left capex for Surat plant (trial run has started). Additionally , remaining capex for Udaipur plant (1.6mt, expected to get commissioned by Dec - 16) is Rs200cr.

Sales mix:

Company sells 60% in Chhattisgarh and 20 - 25% in Orissa form the East plant. From North plant it caters to Gujarat (35%), Rajasthan (30%), Maharashtr a (5%) and rest to other parts of north region.

Clinker production:

The company produced 0.34mt clinker in Q1FY17 as compared to 0.20mt/0.3mt for Q1FY16/Q4FY16.

Lead distance:

Lead distance for North /East plants is 450kms /300kms . The company is planning to take initiatives to reduce the freight cost in the North region.

Petcoke:

The average petcoke cost for the company in Q1FY16 was Rs5000/tn, however it has increased to Rs6,500 - 6,600/tn (spot price) as of now . It uses 90 - 95% petcoke.

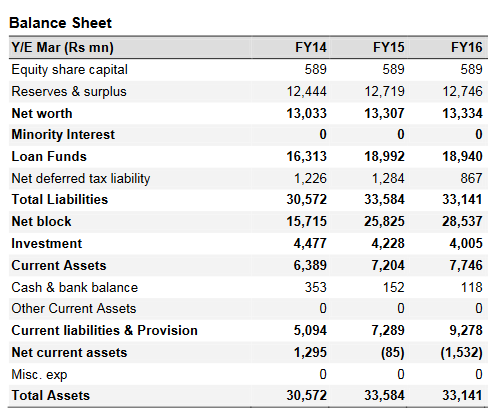

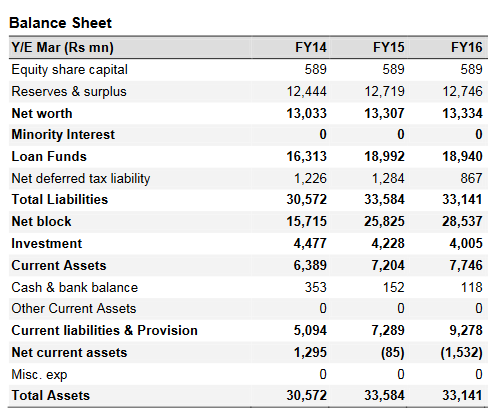

Debt and cash level:

As of 30 th June, 2016 , gross debt of the company stood at Rs1950cr and cash was at Rs450cr. Debt pertaining to the Udaipur Cement stands at Rs500cr. Cash level has increased from Rs250cr as of Mar’16 to Rs450cr as of Jun’16.

Growth outlook:

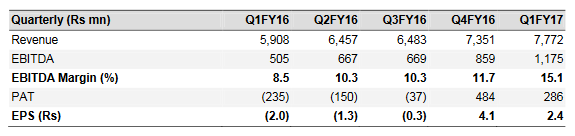

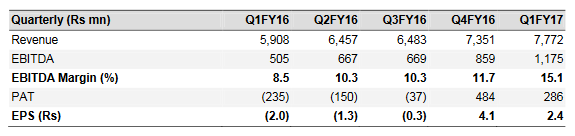

As per the management the North/Gujarat/East regions grew by 1.0%/2.5%/3.0% in Q1FY17. On account of monsoon season, the company is not expecting any revival in the demand in Q2FY17, however, going forward it remains positive on the demand outlook for 2HFY17 and expects demand growth of 7 - 8% growth in this period . This, as per management, is expected to be driven by government spending on infrastructure, smart cities, housing for all scheme and rural growth on the backdrop of good monsoon.

DISCLOSURE: I am invested in the company.

NOTES FROM AR2015-16

Integrated cement plant at Durg started commercial production in FY2016 and has reached almost full capacity utilization in less than a year.1.35 MTPA grinding unit at Surat has been commissioned at the end of FY16 and is in the stabilization phase Total capacity across locations is 13 MTPAThe company plans to deleverage its balance sheet before progressing on brown field expansionsTied up with Snapdeal and is the first company in India to foray into online sellingCo had a capacity utilization of 82% as against an industry average of 66%The co continues to be one of the lowest cost producersThe Durg Plant has performed satisfactorily in the very first full year of its operations and achieved 104% capacity utilization in the last quarter of FY 2015-16. Company has become a third largest player in Chhattisgarh market in a short span of time.

NOTES FROM Q1FY17 Concall

Durg plant:

In the quarter, sales from the East plant was 0.5mt against 0.19mt in Q1FY16. EBITDA has turned positive for the plant in the quarter primarily led by cost reduction as realization remains weak. The company is buying power for the plant at Rs6.8/unit from the grid which is very expensive (CPP generat ion cost is Rs4/unit). In order to save energy costs, it is in process of commissioning WHRS of 7MW (to be operational by Sep - 17). However, it will be able to cater to only 30% of the power requirement of the unit. Hence, the company is also trying to source power from private source which will be relatively lower than the grid cost (but not as low as the CPP cost). This is expected result in cost savings of Rs150/tn. Also, construction of railway siding is under progress and is expected to be com missioned by the FY18 - end which may further lead to savings Rs300 - 350/tn. Through these initiatives, saving of at least Rs300 - 400/tn is expected in the opex of East plant.

Product and sales mix of East plant :

East plant is currently producing 75% PPC and 25% OPC+PSC. This plant is currently selling 60% in Chhattisgarh , 20 - 25% in Orissa and rest in other markets. Larger exposure to Chhattisgarh market has led to lower realization for this unit . Thus company’s focus is more on cost saving so that the profitability can be improved.

Capex update:

The coompany has planned capex for a) Rs150cr for the capacity expansion at Durg plant from 1.8mt to 2.7mt (expected to get commissioned by Jun - 17), b) Rs90cr for WHRS unit of 7MW (to be operational by Sep - 17, c) Rs 100cr for the grinding unit at Orissa (0.6mt), to be operational by Sep - 17, d) Rs150cr for railway siding at the Durg plant (expected to get commissioned by FY18 - end ) and e) Rs20-22 cr left capex for Surat plant (trial run has started). Additionally , remaining capex for Udaipur plant (1.6mt, expected to get commissioned by Dec - 16) is Rs200cr.

Sales mix:

Company sells 60% in Chhattisgarh and 20 - 25% in Orissa form the East plant. From North plant it caters to Gujarat (35%), Rajasthan (30%), Maharashtr a (5%) and rest to other parts of north region.

Clinker production:

The company produced 0.34mt clinker in Q1FY17 as compared to 0.20mt/0.3mt for Q1FY16/Q4FY16.

Lead distance:

Lead distance for North /East plants is 450kms /300kms . The company is planning to take initiatives to reduce the freight cost in the North region.

Petcoke:

The average petcoke cost for the company in Q1FY16 was Rs5000/tn, however it has increased to Rs6,500 - 6,600/tn (spot price) as of now . It uses 90 - 95% petcoke.

Debt and cash level:

As of 30 th June, 2016 , gross debt of the company stood at Rs1950cr and cash was at Rs450cr. Debt pertaining to the Udaipur Cement stands at Rs500cr. Cash level has increased from Rs250cr as of Mar’16 to Rs450cr as of Jun’16.

Growth outlook:

As per the management the North/Gujarat/East regions grew by 1.0%/2.5%/3.0% in Q1FY17. On account of monsoon season, the company is not expecting any revival in the demand in Q2FY17, however, going forward it remains positive on the demand outlook for 2HFY17 and expects demand growth of 7 - 8% growth in this period . This, as per management, is expected to be driven by government spending on infrastructure, smart cities, housing for all scheme and rural growth on the backdrop of good monsoon.

DISCLOSURE: I am invested in the company.

No comments:

Post a Comment