Sagar Cement (SC) is likely to be one of the key beneficiaries of the

huge development in Andhra and Telengana in the next few years.

Demand Scenario

* Amaravati, is planned over 217 sqkm and would require an investment of 4 lakh crores (ref: www.thehindu.com/opinion/op-ed/telangana-rising-amaravathi/article7271810.ece). Telangana already has over 24,000 cr of infrastructure projects under construction. The govt has cleared lift irrigation projects worth 35,000 cr.

* New high-speed rail line announced between Amaravati and Bengaluru

* New stable governments in TN & Kerala

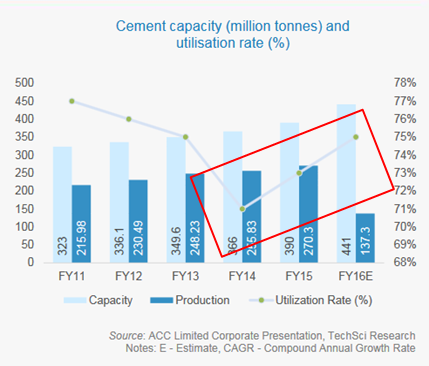

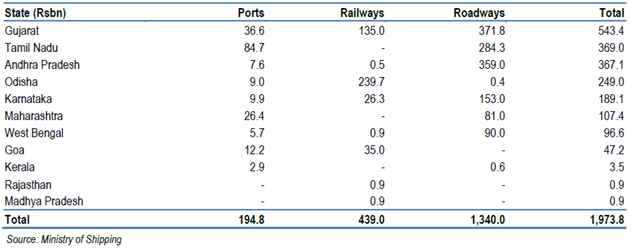

* Huge investments planned in infrastructure projects like the proposed East Coast Economic Corridor, Dedicated Freight Corridor, Diamond Quadrilateral High Speed Rail and National Waterways.

* Decision to use cement instead of bitumen for a large number of big road projects

Investment Plan of the Govt related to infrastructure:

Capacity at strategic locations:

3 MTPA of cement and 2.1 MTPA of clinker at Nalgonda, Andhra PradeshAcquired BMM Cements in Sep 2014 with 1 MT cement and 25MW captive power plant at Anantpur, AP at an EV/ton valuation of $87/ton

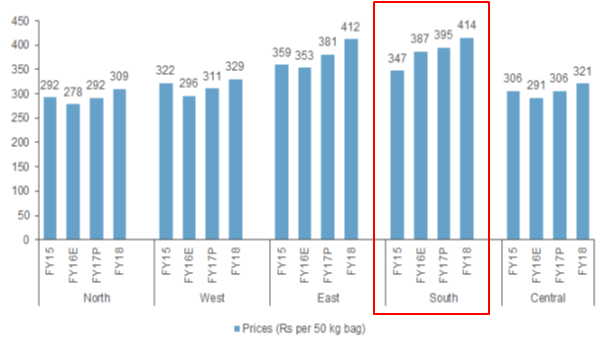

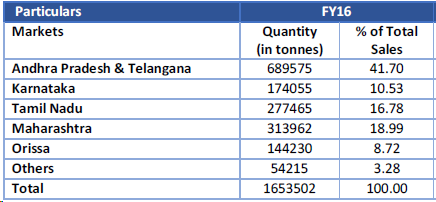

Sales is well spread geographically, tough majority comes from AP & Telangana.

BMM Cements had 3000 acres of land. In Dec 2015, BMM AP govt approved a 20 year mining lease for 1200 acres containing limestone reserves of 155 million tons. This provides raw material guarantee.

The company has setup rail siding to reduce transport cost. 20% of transport to move to rail thereby increasing operating margins.

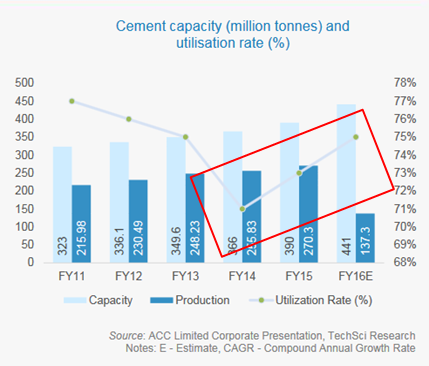

The current capacity utilization is at 56% leaving ample scope for increasing utilization. BMM Cements also had a captive power plant of 25MW capacity. Access to captive power will also reduce operating cost. With the completion of the acquisition, SC will consolidate results from Q1FY17.

Financials:

The stock is available at a market cap of around 1200 cr at a PE of 23. The current replacement cost of cement is about 800 cr/mtpa

Risks

* Aggregate demand does not pick up due to delay in infrastructure spending or lack of turnaround in housing sector

* Adverse Govt policy related to price ,specially for low cost housing projects

* Spike in input costs

DISCLOSURE: I hold the stock and other cement stocks.

Demand Scenario

* Amaravati, is planned over 217 sqkm and would require an investment of 4 lakh crores (ref: www.thehindu.com/opinion/op-ed/telangana-rising-amaravathi/article7271810.ece). Telangana already has over 24,000 cr of infrastructure projects under construction. The govt has cleared lift irrigation projects worth 35,000 cr.

* New high-speed rail line announced between Amaravati and Bengaluru

* New stable governments in TN & Kerala

* Huge investments planned in infrastructure projects like the proposed East Coast Economic Corridor, Dedicated Freight Corridor, Diamond Quadrilateral High Speed Rail and National Waterways.

* Decision to use cement instead of bitumen for a large number of big road projects

Investment Plan of the Govt related to infrastructure:

Capacity at strategic locations:

3 MTPA of cement and 2.1 MTPA of clinker at Nalgonda, Andhra PradeshAcquired BMM Cements in Sep 2014 with 1 MT cement and 25MW captive power plant at Anantpur, AP at an EV/ton valuation of $87/ton

Sales is well spread geographically, tough majority comes from AP & Telangana.

BMM Cements had 3000 acres of land. In Dec 2015, BMM AP govt approved a 20 year mining lease for 1200 acres containing limestone reserves of 155 million tons. This provides raw material guarantee.

The company has setup rail siding to reduce transport cost. 20% of transport to move to rail thereby increasing operating margins.

The current capacity utilization is at 56% leaving ample scope for increasing utilization. BMM Cements also had a captive power plant of 25MW capacity. Access to captive power will also reduce operating cost. With the completion of the acquisition, SC will consolidate results from Q1FY17.

Financials:

The stock is available at a market cap of around 1200 cr at a PE of 23. The current replacement cost of cement is about 800 cr/mtpa

Risks

* Aggregate demand does not pick up due to delay in infrastructure spending or lack of turnaround in housing sector

* Adverse Govt policy related to price ,specially for low cost housing projects

* Spike in input costs

DISCLOSURE: I hold the stock and other cement stocks.

No comments:

Post a Comment